As the sharing economy continues to gain popularity, more and more people are turning to platforms like Airbnb to find unique and affordable accommodations. Vancouver, BC, with its stunning natural beauty and vibrant city life, is a prime destination for travellers from around the world. However, navigating the regulations and finding an Airbnb-friendly building in the city can be a daunting task. In this guide, we will demystify the Airbnb regulations in Vancouver, BC and provide you with valuable tips to help you find the perfect Airbnb-friendly building.

The Benefits of Investing in an Airbnb Business

Investing in an Airbnb business can be a lucrative opportunity, especially in a city like Vancouver, BC. One of the major benefits is the potential for high rental income. With the increasing popularity of Airbnb, many travellers are opting for short-term rentals over traditional hotels. This means that you can charge a premium for your property and potentially earn more than you would with a long-term tenant.

Another advantage of investing in an Airbnb business is the flexibility it offers. Unlike long-term rentals, where you are locked into a lease agreement for a set period of time, Airbnb allows you to rent out your property on a short-term basis. This means that you can use your property for personal use whenever you want, while still generating income when you're not using it.

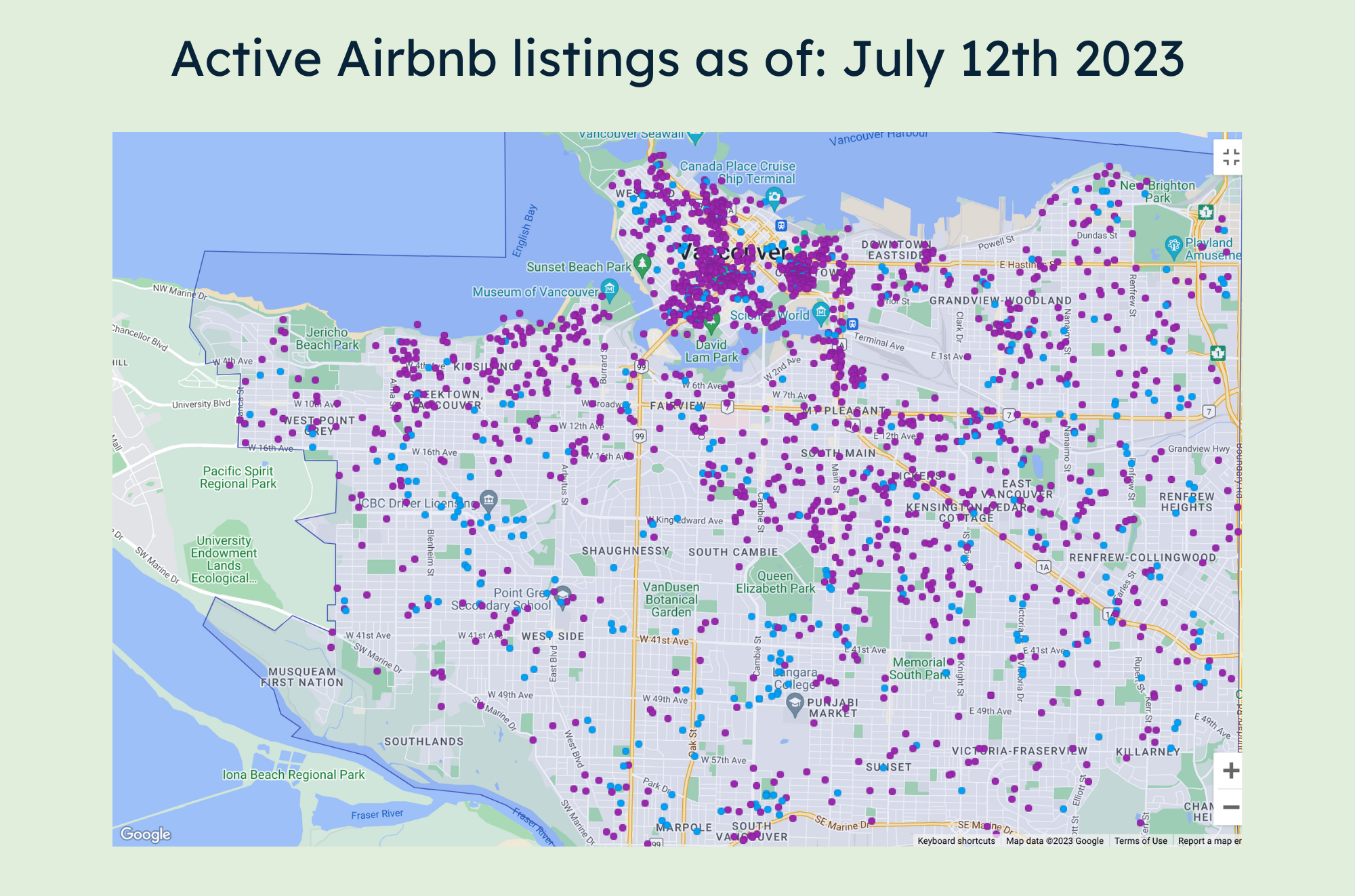

Exploring the Airbnb Market in Vancouver, BC

Before diving into the regulations and finding an Airbnb-friendly building, it's important to understand the Airbnb market in Vancouver, BC. The city is a popular tourist destination, attracting millions of visitors each year. This high demand for accommodations makes Vancouver an ideal location for an Airbnb business.

When it comes to Airbnb listings, Vancouver offers a wide range of options, from cozy apartments in the city centre to luxurious waterfront homes. The key to success in this market is finding a niche that sets your property apart from the competition. Whether it's a unique location, stylish interior design, or exceptional amenities, finding a way to stand out will help attract more guests and increase your rental income.

Factors to Consider When Choosing an Airbnb-Friendly Building in Vancouver

When searching for an Airbnb-friendly building in Vancouver, there are several factors to consider. The first and most important factor is the building's zoning regulations. In Vancouver, short-term rentals are only allowed in certain areas and under specific conditions. It's crucial to familiarize yourself with the city's zoning bylaws and ensure that the building you choose is compliant.

Another factor to consider is the building's strata bylaws. Many buildings in Vancouver are governed by strata corporations, which have their own set of rules and regulations. Some strata bylaws prohibit short-term rentals altogether, while others have restrictions on the number of days a property can be rented out. It's essential to review the strata bylaws before investing in a building to avoid any potential conflicts or legal issues.

Additionally, it's important to consider the building's location and amenities. Properties located in popular neighbourhoods with easy access to public transportation, shopping, and tourist attractions tend to attract more guests. It's also worth considering buildings with amenities like a gym, pool, or rooftop terrace, as these can be attractive selling points for potential guests.

Top Airbnb-Friendly Neighbourhoods in Vancouver, BC

When it comes to finding an Airbnb-friendly neighbourhood in Vancouver, BC, there are several areas that stand out. One of the most popular neighbourhoods for Airbnb rentals is Downtown Vancouver. With its central location, stunning views, and proximity to major attractions like Stanley Park and Granville Island, it's no wonder that this area is in high demand among travellers.

‘Kits’

Another neighbourhood worth considering is Kitsilano. Known for its beautiful beaches, trendy shops, and vibrant nightlife, Kitsilano offers a unique experience for Airbnb guests. The neighbourhood is also home to a variety of accommodation options, from cozy apartments to spacious townhouses, making it a versatile choice for hosts.

‘North Van’

If you're looking for a more peaceful and residential neighbourhood, North Vancouver is a great option. This area offers a tranquil setting with easy access to nature, including hiking trails, parks, and mountains. Many properties in North Vancouver are also located near public transportation, making it convenient for guests to explore the city.

What buildings in Vancouver allow Airbnb/VRBO Rentals?

The majority of condo buildings in downtown Vancouver have established bylaws prohibiting short term rentals, such as Airbnb and VRBO. Despite the fact that the regulations are strict, a few strata buildings still permit these kinds of rental services. Before you are able to do so, you must obtain a license, which may be something to consider when evaluating potential investment properties in the area.

What is Vancouver’s position on Short Term Rentals?

During the past ten years, prices of Vancouver property have risen so much so, that many locals have been unable to afford it. To make housing more reasonable and available, taxes have been set up and regulations have been established in regard to short-term rentals, like those on Airbnb, by the City of Vancouver. This was done in an attempt to encourage properties back onto the market that were previously unoccupied or vacant.

Accommodation with a duration of less than 30 days is considered as a 'short term' rental. Before April 2018, these types of rentals were limited to licensed hotels and bed and breakfasts. From September 2018, people who own homes were able to get a short-term rental permit and gain additional revenue by using their property.

Although it is now permissible to rent out for a short period of time, the following conditions must be met:

¨ Comply with the regulations of the City of Vancouver related to Airbnb/VRBO as outlined below.

¨ Be permitted by the strata bylaws

Can the Property I Own in Vancouver Be Used for Airbnb?

In order to obtain a short term rentals license in Vancouver, the property must serve as the primary residence for the owner. This means that the house or single room must be lived in at least 180 days out of the year. In addition, the owner must acquire the license and obtain approval from the strata body before becoming eligible. Finally, it is necessary for the property to meet the safety standards set in place and be a legal dwelling.

Vancouver Buildings That Permit Airbnb Rentals

The accuracy and recency of this list of Airbnb/VRBO approved properties in Vancouver is a goal of ours, yet strata rules can be altered without warning. This is the most current compilation of buildings permitting short-term rentals for Airbnb/VRBO…

Vancouver;

¨ 180 E 2nd Avenue (Second + Main) - NEW

¨ 350 E 2nd Avenue (Mainspace)

¨ 250 E 6th Avenue (District)

¨ 289 E 6th Avenue (Shine)

¨ 311 E 6th Avenue (The Wohlsein)

¨ 555 Abbott Street & 183 Keefer Place (Paris Place)

¨ 618 Abbott Street, 688 Abbott Street & 58 Keefer Place (Firenze)

¨ 633 Abbott Street, 689 Abbott Street & 188 Keefer Place (Espana)

¨ 890 Broughton Street

¨ 1003 Burnaby Street (The Milano)

¨ 1050 Burrard (The Wall Centre)

¨ 1160 Burrard Street (Burrard Health)

¨ 1238 Burrard Street (Altadena)

¨ 370 Carrall Street (21 Doors)

¨ 1010 Chilco Street (The Chilco Park)

¨ 1788 Columbia Street (Epic at West)

¨ 55 E Cordova Street (Koret Lofts)

¨ 2040 Cornwall Avenue (Bryanston Court)

¨ 219 E Georgia Street (The Flats)

¨ 1249 Granville Street (The Lex)

¨ 933, 955, & 983 E Hastings Street (Strathcona Village)

¨ 1010 Howe Street (Fortune House)

¨ 718 Main Street (Ginger)

¨ 1166 Melville Street (Orca Place).

¨ 989 Nelson Street (Electra)

¨ 28 Powell Street (Powell Lane)

¨ 933 Seymour Street (The Spot)

¨ 1372 Seymour Street (The Mark)

¨ 919 Station Street (The Left Bank)

¨ 928 Richards Street (The Savoy)

¨ 231 E Pender Street (Framework)

¨ 33 W Pender Street (33 Living)

¨ 2458 York Avenue (York Avenue)

¨ 1060 Alberni Street – The Carlyle

¨ 907 Beach Avenue – Coral Court

¨ 1226 Hamilton Street – Greenwich Place

¨ 141 Water Street – Malkin Building

¨ 1550 Barclay – The Barclay

¨ 557 E Cordova Street – Cordovan

¨ 233 Kingsway – VYA

¨ 1200 & 1288 W Georgia – Residence on Georgia

¨ 27 Alexander St (Alexis)

¨ 1331 Homer St (The point 2)

¨ 150 E Cordova St (In Gastown)

¨ 1200 Alberni St (The Palisades)

¨ 1288 Alberni St (The Palisades West)

North Vancouver;

¨ 108 E 8th Street – Crest by Adera

¨ 137-149 St Patrick’s Avenue – Synergy

¨ 135 W 2nd Street – Capstone

¨ 649 E 3rd Street – The Morrison

¨ 1633 Tatlow – Tatlow Homes

¨ 550 Browning – Tanager

It is important to note that even if a property is on this list, short-term rentals are subject to the building's strata regulations which are subject to change. It is essential for individuals interested in renting out their space to confirm that the property they own meets all requirements and regulations set by their building. This includes ensuring that there is no noise disturbance, no damage to the property, and all necessary paperwork filed with the strata council. Additionally, it is important for owners to check with their insurance provider to ensure they have adequate coverage for renters. Once these steps are completed, individuals can feel confident in renting out their space on Airbnb or VRBO.

In-depth Insight into Vancouver's Rules on Short-Term Rentals

In 2018, Vancouver implemented regulations to enable homeowners to take part in the sharing economy with online platforms such as Airbnb, VRBO, Booking.com, Homeaway and FlipKey. If you are interested in hosting in the city, here is what you need to be aware of…

What Vancouver Characterizes as a Short-Term Rental

The demand for housing in Vancouver is very high, leading to an affordable housing crisis. In return, the city has created a system to manage short-term rentals that will aid in preserving the interests of both homeowners and renters.

The city of Vancouver has adopted the "sharing economy" concept, which necessitates that those offering short-term rentals share their principal residence with their customers. In order to ensure people are abiding by this regulation, Vancouver has put in place a mandatory business license for short-term rentals, effective September 1st, 2018. This measure has been taken to help people living in Vancouver to supplement their housing costs by utilizing their primary residence to earn additional income.

The city of Vancouver outlines that a short-term rental is a dwelling, either a full home or a single bedroom, that can be rented out for less than 30 days. Accommodations such as bed and breakfasts and hotels cannot be housed at the same address as a short-term rental. Furthermore, the short-term rental must be from the operator's primary residence where they live either as an owner or tenant, and their bills, identification, taxes, and insurance must be registered there. Additionally, no more than two adults can occupy each bedroom and only one booking is allowed per dwelling unit. Lastly, secondary or basement suites can only be rented out for short-term use if the operator resides there all of the time.

In summary,

¨ Obtain consent from the landlord or strata association.

¨ Only rent out their principal residence.

¨ Only permitted to rent basement suites, laneway houses, and other secondary suites if operator lives there full time.

¨ Must have a short-term rental business license that is showcased in all advertising and postings.

¨ Meet the requirements of a responsible operator.

Becoming Familiar with the Short-Term Rental License of Vancouver

To obtain a short-term rental business licence in Vancouver, an application fee of $66 must be paid, and then an annual fee of $109 will need to be renewed by December 31st of each calendar year (although the fee may be pro-rated the first year based on the start date of the business). As these licences are only able to be issued to individuals, not businesses, societies or commercial operations, tenants must obtain permission from their landlord or make sure they are adhering to their strata's bylaws before submitting an application.

The short-term rental business licence must be prominently displayed on any form of advertising or marketing materials for the accommodation. When listing a Vancouver accommodation on Airbnb, hosts will be asked to provide their short-term rental business licence number. Operators must also adhere to basic fire-safety requirements, such as posting a fire safety plan at all entrances and exits, having or installing interconnected smoke alarms on each floor and in each bedroom, having or installing fire extinguishers on each floor, and having or installing carbon monoxide detectors on every floor with gas appliances. All fire-safety equipment and alarms must be regularly inspected and maintained, with the business licence owner maintaining records of the check-ups. To assist those preparing their property for the application process, the city of Vancouver has supplied a helpful PDF file https://vancouver.ca/files/cov/responsible-short-term-rental-operator-handbook.pdf that explains the requirements.

Punishments

Penalties can be defined as punishments that are imposed on someone for breaking a rule or law.

Vancouver is committed to making sure that short-term rental operators maintain their licence and abide by all rules. To guarantee that these regulations are being followed, the city is authorized to issue fines of up to $1,000 for every breach, and may also initiate legal action. In cases of commercial operators or multiple offenders, they may be taken to court and can be fined up to $10,000.

Failing to renew your business licence for a short-term rental before December 31st will result in a penalty, being either 10% of the licence fee or $40, whichever is greater. If you no longer wish to offer short-term rentals, it is important to inform the city so as to prevent receiving any further renewal notices.

Vancouver is committed to regulating short-term rentals, as evidenced by the data available on their webpage https://vancouver.ca/doing-business/short-term-rentals.aspx. Statistics are tracked on the number of active listings vs. licenses issued, with the amount of licenses under investigation, warnings, legal orders, and much more. With the city's strong stance on enforcement, it is important for homeowners to know about the licensing process and the consequences of operating without one.

Step-by-Step Guide to Licence Registration

This guide provides a breakdown of the steps needed to complete the licence registration process.

It is possible to acquire a short-term rental business licence from the city's webpage https://vancouver.ca/doing-business/applying-for-short-term-rental-business-licence.aspx with the application process being easy to understand. Below is all the necessary information and steps one needs to take in order to register for Vancouver's short-term rental business licence.

1. To begin the application process, please go to this page https://app.vancouver.ca/businesslicence_net/STRdefault.aspx.

2. Enter your principal residence address in Vancouver and confirm that it is valid.

3. State what type of residence it is (e.g. an apartment/condo unit, coach/lane house, duplex/triplex/fourplex, single/detached house, suite in a house, or townhouse), as well as whether you own or rent the property.

4. If you are renting, a follow-up question will appear regarding whether your landlord permits short-term rentals; you will also be asked whether your strata bylaws allow such rentals, with the choices of yes, no, or "There is no strata council for this residence" to select from.

5. You will be shown the business owner requirements that you must read and agree to.

6. Provide your first and last name, as well as the name of your co-applicant if applicable (note that the co-applicant must also reside in the principal residence you previously entered).

7. Enter your phone number and email address, with the latter only necessary if you wish to receive your short-term rental business licence renewal notice by email.

8. A review of the fees to be paid (one-time application fee and yearly licence fee) along with information about the fees (no tax charged, and the annual licence fee is prorated from the date of purchase to December 31st) will be displayed.

Gaining Familiarity with the Tax Implications Surrounding Revenue Generated from Airbnb

When considering starting a short-term rental in Vancouver with websites like Airbnb, VRBO, Homeaway, Booking.com, and TurnKey, one must be aware of their tax situation. The CRA has regulations for stating rental revenue, and one must understand if it is necessary to submit it as a part of their individual income tax return or if it should be reported in a business tax return.

Including services beyond a standard overnight stay, like providing breakfast or cleaning the room during a stay, can cause your Airbnb or short-term rental to be viewed as a business instead of just personal rental income. Being claimed as a business allows you to declare many items as write-offs, but you may be subject to capital gains taxes when you eventually sell the property. As opposed to claiming it as a rental, you have fewer deductions but capital gains won't be incurred if the property is your primary residence.

If you generate income over $30,000 yearly, you must register for a GST number and remit taxes. Airbnb collects provincial sales tax (8%) and municipal/regional district tax (up to 3%) from its guests in addition to your fees, and then passes this to the British Columbia government on your behalf. For further information on this, you can take a look at the article from TurboTax or the CRA website. Ultimately, you should consult your tax advisor or accountant for definitive answers about how to report your taxes.

Useful links for Short-Term Rentals

¨ The City of Vancouver provides a Short-Term Rental Business Licence, which can be found at https://vancouver.ca/doing-business/short-term-rentals.aspx

¨ To determine if you are eligible to receive short-term rental services in Vancouver, please visit the city's Short-Term Rental Eligibility Questionnaire found at https://vancouver.ca/doing-business/short-term-rentals-check-if-you-can-rent.aspx https://vancouver.ca/doing-business/short-term-rentals-check-if-you-can-rent.aspx

¨ Vancouver mandates certain criteria for companies that engage in short-term rentals: https://vancouver.ca/doing-business/short-term-rental-business-licence-requirements.aspx

¨ Individuals who wish to apply for a Short-Term Rental Business Licence in Vancouver can find the necessary information on the City of Vancouver's website: https://vancouver.ca/doing-business/applying-for-short-term-rental-business-licence.aspx

¨ Questions about Home Sharing in Vancouver, CA as put forth by Airbnb can be found at this link: https://www.airbnb.ca/help/article/2239/vancouver-s-home-sharing-registration-process-frequently-asked-questions/. Information regarding their registration process is included.

¨ Information regarding Airbnb Canada's Collection and Remittance of Occupancy Tax can be found here: https://www.airbnb.ca/help/article/2283/occupancy-tax-collection-and-remittance-by-airbnb-in-canada. Airbnb Canada is responsible for collecting and remitting occupancy tax.

It is important to know that if you are a homeowner, you may be able to use the principal residence exemption to avoid paying capital gains tax on the sale of your home. However, this exemption does not apply if you are renting out your property as a short-term rental. You must also ensure that you are compliant with local regulations regarding short-term rental occupancy. Additionally, if the revenue from your rental exceeds $30,000 per year, it is likely that you will be required to register for a GST number and remit taxes. Airbnb collects provincial sales tax (8%) and municipal/regional district tax (up to 3%) from its guests in addition to your fees and then passes this on to the British Columbia government on your behalf. Ultimately, it is important to consult with an accountant or tax advisor for definitive answers about how to report your taxes accurately and legally.

Best Practices for Hosting an Airbnb in Vancouver, BC

Hosting an Airbnb in Vancouver, BC comes with its own set of challenges and responsibilities. To ensure a positive experience for both you and your guests, here are some best practices to follow:

¨ Provide clear and accurate descriptions: Be honest about your property and clearly describe its amenities, location, and any rules or restrictions. This will help manage guest expectations and avoid any misunderstandings.

¨ Communicate promptly and professionally: Respond to guest inquiries and messages in a timely manner and maintain a professional tone in your communication. Clear and effective communication is key to providing a positive guest experience.

¨ Keep your property clean and well-maintained: Regularly clean and maintain your property to ensure that it's in top condition for each guest. This includes regular inspections, repairs, and deep cleaning between guests.

¨ Be a good neighbour: Respect your neighbours' privacy and ensure that your guests adhere to any building or neighbourhood rules. This will help maintain a positive relationship with your neighbours and minimize any potential complaints.

Conclusion

Investing in Vancouver, BC offers a range of benefits, from the city's thriving economy to its stunning natural beauty. Whether it's real estate, business opportunities, or simply enjoying the high quality of life, Vancouver has something for everyone. So, don't miss out on the chance to invest in this vibrant city.

Navigating the Airbnb regulations and finding an Airbnb-friendly building in Vancouver, BC may seem daunting, but with the right knowledge and resources, it can be a rewarding and profitable venture. By understanding the regulations, researching the market, and following best practices, you can create a successful Airbnb business in one of Canada's most vibrant cities. So, take advantage of the benefits of investing in Vancouver, BC and start your journey into the world of Airbnb today.

Comments:

Post Your Comment: